In this post, I will share some tips for Budgeting for College Students with roommates. As a college student, managing your finances can feel like a daunting task, especially when you’re sharing a living space with roommates. Budgeting for college students with roommates is not just about covering your expenses.

It’s about coordinating with others to ensure everyone’s financial needs are met. Living with roommates can save you money on rent, utilities, and other costs, but it also requires careful planning and open communication to avoid conflicts.

Whether you’re a freshman just starting or a seasoned student looking to refine your financial habits, this guide will help you navigate the challenges and benefits of budgeting with roommates. In this article, I’ll walk you through the process of creating a budget that works for you and your roommates.

We’ll cover everything from setting up your budget to splitting shared expenses, and I’ll share practical tips to help you save money and maintain harmony in your shared living space. By the end, you’ll have the tools and knowledge to make budgeting with roommates a stress-free experience.

Budgeting for College Students with Roommates

Living with roommates is a popular choice for college students, and for good reason. It’s a great way to save money, build friendships, and learn valuable life skills. According to BestColleges, sharing expenses like rent and utilities can significantly reduce your monthly costs, especially in high-cost areas like San Francisco or Honolulu.

However, sharing a space means you’ll need to navigate shared expenses, which can lead to tension if not handled properly. That’s where budgeting comes in.

A well-thought-out budget can help you and your roommates avoid misunderstandings, ensure fairness, and even save money in the long run. The key is to start with a clear plan that includes both your finances and the shared expenses that come with living together.

This involves understanding your financial situation, agreeing on how to split costs, and setting up systems to track expenses and payments. It also requires open communication and a willingness to compromise when needed.

Personal Budgeting: Start with Yourself

Before you can start splitting expenses with your roommates, you need to have a solid understanding of your own financial situation. This means creating a personal budget that accounts for all your income and expenses. Here’s how to get started:

- List Your Income: Start by tallying up all your sources of income. This might include scholarships, grants, loans, family contributions, part-time jobs, or savings. Knowing exactly how much money you have coming in each month is the foundation of your budget.

- Track Your Expenses: Next, list all your fixed and variable expenses. Fixed expenses are those that stay the same each month, like tuition, rent, or your phone bill. Variable expenses can fluctuate, such as groceries, transportation, or entertainment. Don’t forget to include periodic expenses, like textbooks or subscription services.

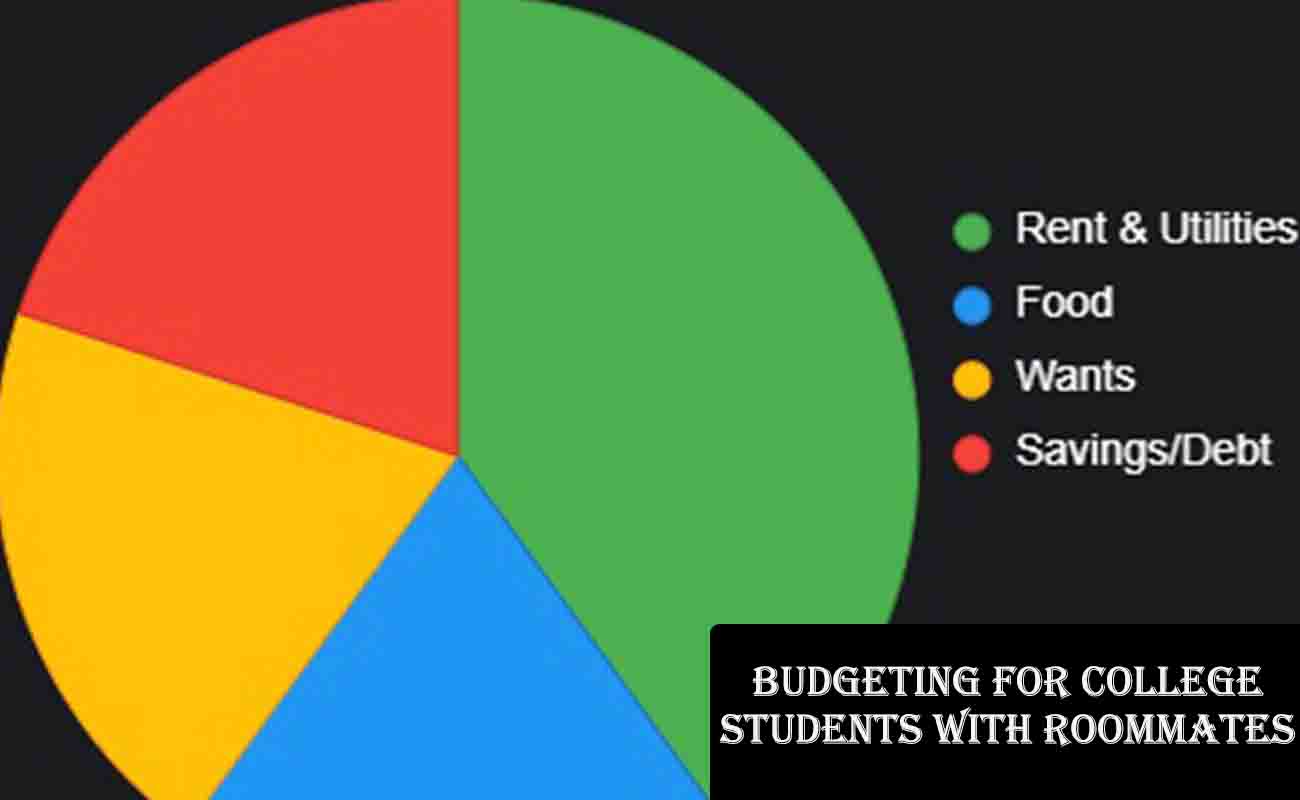

- Use a Budgeting Method: A popular budgeting method is the 50/30/20 rule, where 50% of your income goes to needs (like rent and food), 30% to wants (like dining out or hobbies), and 20% to savings or debt repayment. However, as a college student, you might need to adjust this rule. For example, Fetch.com suggests a 40/20/20/20 split for part-time students, with 40% for rent and bills, 20% for food, 20% for wants, and 20% for unexpected expenses.

- Set Financial Goals: Think about both short-term and long-term goals. Short-term goals might include saving for a new laptop or a weekend trip, while long-term goals could be studying abroad or building an emergency fund. Having clear goals can help you stay motivated to stick to your budget.

Pro Tip: Use online tools or apps to make budgeting easier. Websites like Empeople’s Financial Success Center offer free calculators and resources to help you track your spending and set savings goals.

Shared Expenses: Splitting Costs Fairly

Once you have your budget in place, it’s time to tackle the shared expenses that come with living with roommates. These typically include rent, utilities, internet, and sometimes groceries or household items. Here’s how to handle them:

- Rent and Utilities: If all rooms are equal, splitting rent and utilities equally makes sense. However, if there are differences in room size or amenities (like a private bathroom), you might need to adjust the split. For example, the person with the larger room might pay a slightly higher share of the rent. Empeople suggests discussing rent price ranges that fit everyone’s finances before signing a lease.

- Internet and Subscriptions: Decide whether to share the cost of internet, streaming services, or other subscriptions. These can often be split equally, but make sure everyone agrees on the necessity of each service. For example, Navy Federal Credit Union notes that sharing streaming subscriptions can help everyone save money.

- Groceries and Household Items: Groceries can be tricky. You can either keep them separate or share certain staples like milk, bread, and condiments. If you choose to share, you can rotate who buys them each month or split the cost when shopping together. For household items like cleaning supplies, toilet paper, and paper towels, consider setting up a system where everyone contributes to a shared fund or takes turns buying them.

- Furniture and Appliances: If you’re furnishing the place together, decide who will bring what and how to handle joint purchases. For example, you might split the cost of a couch or kitchenware, but you’ll need to agree on who gets to keep it when someone moves out.

| Expense Type | Splitting Strategy | Example |

|---|---|---|

| Rent | Equal or adjusted based on room size | Equal: $500 each; Adjusted: $550/$450 |

| Utilities | Equal split or based on usage | $100 split equally among 3 roommates |

| Groceries | Separate or shared staples | Rotate buying milk, bread, etc. |

| Household Items | Pooled fund or rotation | $20 monthly fund for cleaning supplies |

Tip: Use a shared spreadsheet or app to track who has paid for what. This can help prevent confusion and ensure everyone is contributing fairly. You can also set up a system where bills are paid directly from each person’s account to avoid one person being responsible for everything.

Communication and Agreements: The Key to Harmony

Living with roommates is as much about people as it is about money. Clear communication and mutual understanding are essential to avoid conflicts over finances. Here are some tips to keep things running smoothly:

- Discuss Expectations Upfront: Before moving in, have an open conversation about how bills will be paid, who is responsible for what, and what happens if someone can’t pay their share. Money Management International suggests choosing a place with individual leases for off-campus living to simplify rent and utility payments.

- Put It in Writing: A written agreement can help prevent misunderstandings. This doesn’t have to be a formal contract—just a simple document outlining how expenses will be split and what each person is responsible for. It can also include rules about guests, noise, and shared spaces.

- Regular Check-Ins: Set aside time each month to review your budget and expenses together. This can help you catch any issues early and make adjustments as needed. For example, if utility bills are higher than expected, you can discuss ways to reduce costs, like adjusting the thermostat or turning off lights when not in use.

- Handle Disagreements Gracefully: If conflicts arise, address them promptly and calmly. Try to find a solution that works for everyone, and remember that compromise is key. If one roommate is consistently late with payments, you might need to set up a system where they pay their share directly to the landlord or utility company.

Fun Fact: According to Money Management International, 75% of first-time college students have never shared a room before. This means many of your roommates might be new to this, too, so patience and understanding are crucial.

Saving Money: Maximizing the Benefits of Shared Living

Living with roommates offers plenty of opportunities to save money, but you need to be intentional about it. Here are some strategies to help you stretch your budget further:

- Bulk Buying: Buying groceries or household items in bulk can be cheaper than buying individually. If you and your roommates can coordinate your shopping, you can split the cost and save money. BestColleges notes that pooling resources for groceries can significantly reduce costs.

- Shared Subscriptions: Consider sharing subscriptions like streaming services, gym memberships, or meal delivery kits. This can significantly reduce your monthly expenses.

- Utility Savings: Be mindful of utility usage. Agree on thermostat settings, turn off lights and appliances when not in use, and consider budget billing programs that average out your utility costs over the year. Empeople suggests setting expectations for thermostat and appliance use to avoid surprise bills.

- Transportation: If you all need to get around, look into shared transportation options like carpooling or public transit passes. This can save everyone money compared to each person having their own car.

Pro Tip: If you’re tempted to use credit cards for unexpected expenses, consider alternatives like a prepaid or secured credit card. Money Management International notes that college seniors graduate with an average credit card debt of $4,100, so it’s important to be cautious.

Long-term Financial Planning: Looking Beyond College

While budgeting for the present is important, it’s also crucial to think about your long-term financial health. Here are some tips to set yourself up for success:

- Avoid Credit Card Debt: If you need a credit card, use it responsibly. Pay off the balance in full each month to avoid interest charges. If you’re prone to overspending, consider a prepaid or secured card instead.

- Build an Emergency Fund: Aim to save at least 3-6 months’ worth of expenses in an emergency fund. This can help you cover unexpected costs without going into debt.

- Plan for the Future: Think about your financial goals after college, whether it’s paying off student loans, saving for grad school, or buying a car. Starting good financial habits now will make these goals easier to achieve.

FAQs: Common Questions About Budgeting with Roommates

- How do we split rent if our rooms are different sizes?

If rooms are of different sizes, you can adjust the rent split based on the size of the room. For example, the person with the larger room might pay 55% of the rent, while the person with the smaller room pays 45%. Make sure to agree on this split before moving in. - What if a roommate doesn’t pay their share of the bills?

If a roommate fails to pay, first try to communicate with them to understand the issue. If they’re unable to pay, you might need to cover their share temporarily, but this should be a last resort. Consider setting up a system where bills are paid directly from each person’s account to avoid this situation. - How can we handle shared groceries?

You can either keep groceries separate or share certain items like milk, bread, and condiments. If you choose to share, you can rotate who buys them or split the cost each time. Make sure to label items that are not for sharing. - What should we neutropics do if our budgets are very different?

If your budgets are different, be transparent about what you can afford. You might need to find a living situation that fits everyone’s financial capabilities or adjust the split of expenses based on income.

Conclusion

Budgeting for college students with roommates is all about planning, communication, and compromise. By creating a personal budget, agreeing on shared expenses, and maintaining open communication, you can enjoy the financial benefits of shared living while avoiding conflicts.

Use tools like spreadsheets or apps to track expenses, take advantage of cost-saving opportunities like bulk buying, and think about your long-term financial goals. With these strategies, you can make the most of your college living experience and build a strong financial foundation for the future.

Key Citations

- Budget for College Student Living Off Campus

- How to Budget as a College Student

- How College Students Can Create a Realistic Budget

- Guide to Budgeting for College Students

- Budgeting & Living with a Roommate

- Roommates and Finances

- Tips for Building a Budget with Your College Roommates

- Budgeting with Roommates for Beginners

- How to Budget as a College Student

- How Much Does a College Student Spend a Month?